TOP 15 SOLANA AIRDROPs 2024 [Guide]

We dive deep into the Solana trenches farming airdrops to make wife-changing money

![TOP 15 SOLANA AIRDROPs 2024 [Guide]](/content/images/size/w1200/2024/05/Top-Solana-Airdrops.webp)

So, airdrops huh? The frenzy that initially started with Uniswap dropping 400 UNI tokens worth $1600 at the start has been continued well into the bear market and the depths of despair in 2023 and will continue into the what looks and seems to be a bull market of 2024.

So, how does someone cash on these airdrops especially if you’re someone like me and have 1 satoshi to your name? Enter this blog.

In this blog, we’ll be taking a closer look into various ecosystems starting from Solana to Tia, Ethereum and other L2s and see how you can utilize a few tasks and grow your portfolio to a bigger and better number!

Remember to cash out if you’ve made life-changing gains

Solana

With the humongous price appreciation of SOL going from $8 during the FTX crash to over $100 right now have come a few airdrops in the form of PYTH, JTO and to be launched JUP.

Are you excited for Jupuary?

Costing as little as $0.0002, farming airdrops on Solana can literally be done by anyone and should definitely be your #1 priority if you want to grow your smol portfolio. In our list, we’ll be taking a look into a few big heavy hitting protocols of Solana from Drift Protocol, Jupiter and MarginFi to some relatively less known protocols like Parcl, RainFi, Texture etc.

So, without further ado, let’s jump right in!

Drift Protocol

First on the list is Drift Protocol. While everybody knows it as a Perps DEX, you can do a bit more than just trade perps there to increase your chances of getting an airdrop. In addition to the Perps Dex, Drift also has their Lend/Borrow program as well as their DLP or Drift Liquidity Provider which is their MM that trades perps for you. I believe utilizing all these avenues can be beneficial in scoring a bigger airdrop.

For every $100 you deposit, you can split them in a ratio of 40:40:20 for DLP: Lend/Borrow: Perps. The reason for lower value on Perps is that volume generation can be done easily via 2x leverage on their Perps while you’ll need to put more USDC into other 2 avenues to earn some boost on your potential airdrop.

TL;DR

- Generate as much volume as you can on Perps

- Deposit assets in their DLP

- and Lend/Borrow assets to earn yield

If you haven’t signed up on Drift, use my referral link: https://app.drift.trade/ref/ibuyperps

Jupiter

Coming onto Jupiter which is arguably the best DEX Aggregator across all the chains. When they unveiled their Round 1 of Growing the Pie JUP Airdrop , the also talked about how there would be 3 more rounds of Airdrop and thus to potentially qualify and earn as much points as you can for that, here’s what you should do.

Jan

— Jupiter 🪐 (@JupiterExchange) December 22, 2023

Jup will launch in Jan, and we will do it together as a community.

Why together? Cause it's more fun together, and cats like to have fun.

In the meantime, here's very important info about feeding cats and growing pies. Read & share widely, especially the cute cats!

👇 https://t.co/rCvONCCOjY

First and foremost understand that Jupiter currently has 2 products. Swap and it’s own AMM based Perps DEX. To potentially qualify for the airdrop, keep swapping to generate as much volume as you can. An easy swap that you can perform is going from mSOL to jitoSOL and vice versa or USDT to USDC and vice-versa.

Another leg of this airdrop in my opinion would be for those that trade on their Perps DEX and so don’t forget to open and close a position once a day to keep your fee loss to a minimal but at the same time generate volume on their Perps by trading on higher leverage up to 100x

Beware of high leverage degen gamblers!

TL;DR

- Generate volume via swaps either b/w LSTs like mSOL to jitoSOL or b/w stables USDC to USDT and vice versa

- Try to generate some minimal volume on their Perps DEX as that might lead to some additional points for their further rounds of airdrop

MarginFi

Announcing their points system almost an year back, MarginFi has always been in the limelight whenever there was any potential airdrop twitter threads.

1/ Introducing mrgn points

— marginfi ◼️ (@marginfi) July 3, 2023

🧵 pic.twitter.com/LcekodfSEM

One of the top Borrow/Lending platforms on Solana, the tasks are pretty simple when it comes down to earning points and potentially converting those points for an airdrop. Simply, Borrow or Lend your assets. Additionally, you can also stake your SOL to receive LST tokens which might further enhance your airdrop chances.

TL;DR

- Borrow or Lend your assets to generate points

- For an add-on bonus, stake your SOL to receive LST tokens

Kamino Finance

Teasing their points system, next up on the list is Kamino Finance. Kamino Finance is deemed as a liquidity aggregator on Solana. It has 2 products namely their Borrow/Lend platform and Liquidity provision and 2 beta products Multiply and Long/Short. To qualify for a potential airdrop, generate as much volume as you can on Borrow/Lend while at the same time utilize their beta products to stand a chance for any boost in point. However, I would advice you against doing so right now until their points system is launched.

TL;DR

- When their points system launches, generate volume via their Borrow/Lend

- Use their beta products to stand an additional chance of any boost in points

Update

They’ve announced on Solana Ecosystem call that they’ll be releasing the points system at the end of Jan to pave their way for their token - KMNO.

🚨 BREAKING BIG:@Kamino_Finance Season 1 Points starting early next week. pic.twitter.com/qyCfTjD4cX

— SolanaFloor | Powered by Step Finance (@SolanaFloor) January 11, 2024

Zeta Markets

Another perps DEX on our list is Zeta Markets. A CLOB based DEX on Solana and a rising competitor to Drift, Zeta introduced their Z-Score system back in October 2023 which is the premise to their token launch.

We're excited to announce the launch of Z-Score, the curtain-raiser to the launch of our token.

— Zeta Markets | v2 Live 🔥 (@ZetaMarkets) October 26, 2023

Traders now have the opportunity to stack Z-Score, climb the leaderboard, and build up a rewards base for the future.

You won't want to midcurve this 😏

Let's dig in 👇 pic.twitter.com/4D0nL9SvKT

Introducing Z-Score by Zeta Markets

Similar to Drift, to increase your Z-Score, simply generate more volume on their Perps Dex and trade profitably (A very hard thing to do for most of you). The higher your Z-score is the bigger your airdrop will be.

TL;DR

- Trade profitably to generate volume and enhance your points via boosts

MeteoraAG

Powering Solana’s liquidity via it’s dynamic liquidity pools is Meteora. They recently released their DLMM pools and in my opinion hinted at an airdrop based on the DLMM liquidity providers.

1/ Announcing The Massive Meteora Stimulus Package

— Meteora (@MeteoraAG) December 2, 2023

1. DLMM - Dynamic Fees & Precise Liquidity

2. Expert DAO - The best brains of DeFi

3. 10% Stimulus - Starting 1st Jan 24

Combining product, community & incentives, we aim to massively supercharge Solana TVL growth in 2024 pic.twitter.com/Ko2OIdWDRe

Meteora's DLMM based Stimulus package plan

Given this, I feel like utilizing any other product of theirs i.e Dynamic vaults and Pools is kind of useless and users should more or less focus on this to maximize their chances of getting an airdrop.

Their DLMM pools are similar to how any other liquidity pool works so you have to deposit 2 assets and sit back. The more capital you deploy should result in a bigger airdrop however any AMM pool has a risk of Impermanent Loss and which is why I feel that only deposit some 1:1 token pool pairs like USDC-USDT or bSOL-SOL pool etc.

TL;DR

- Best way to be eligible for their potential airdrop is by deposting into their DLMM Pools

Parcl

Next up on our list is Parcl. Parcl allows you to long or short real estate across various locations including London, New York, Texas and many other from across the globe. They also have their points/leaderboard system which you can enter by generating volume as well as depositing liquidity.

So, simply connect your wallet on Parcl and start generating as much volume as you can. You can also deposit liquidity in their pools to each 3x as much points as you would have by trading.

You can also check out their thread below explaining Parcl points

There are 2 simple ways for users to stack up on Parcl Points:

— Parcl (@Parcl) January 8, 2024

💧 Provide liquidity

🏦 Trade markets

Over the past month, several detailed primers have been published on LPing & trading — covering everything from risk mitigation to position management.

All you need to know 🧵 pic.twitter.com/VZ9It6HQFZ

TL;DR

- Generate volume to climb up the leader board

- Provide liquidity to earn more points

If you haven’t signed up already, use my referral code: ibuyestate

Cega Finance

Another DeFi dApps, related however to earning yield utilizing Options, Cega Finance is sort of the primary under-the-radar protocol being mentioned here. They have various pools that you can deposit assets in and earn yield. They also have their own NFT collection that you can buy as an additional measure in getting a potential airdrop.

Psst, We'll be doing a deep dive into Cega Finance in a later blog

TL;DR

- Deposit assets and generate volume via their Vaults

- Hold their NFT for any additional benefits

Phantom

Rumors of Metamask which is the biggest ETH/L2 chains wallet spreading across crypto twitter leads people to believe that Phantom might also do a similar airdrop. However, while people might speculate, Phantom has tweeted a few days back that they don’t have any plans on launching a token. It thus makes it a very low priority for me in terms of farming for an airdrop and should be treated mostly as such.

Reminder: Phantom does NOT have any plans to launch a token. Anything saying otherwise is a scam. Please be careful out there!

— Phantom (@phantom) January 4, 2024

However, if you still want to farm this rare chance of an airdrop then generate volume via their in-built swap as I believe that would be the primary pointer for airdrop.

TL;DR

- Low priority since Phantom explicitly mentioned no token launch planned. However, if still need be done, generate volume via their in-built swaps

Symmetry Finance (SymmetryFi)

Having hinted at their token plan, I believe utilizing Symmetry now is vital.

February is for Symmetry 👀

— Symmetry (@symmetry_fi) January 12, 2024

hmmmm

Symmetry is an Asset Management protocol that let’s you deposit tokens into community-created vaults. Recently they also dropped JTO to ySOL holders which leads me to believe that holding ySOL and dropping a few dollars into a few other vaults could be the key to getting an airdrop.

Hey $ySOL holders, did you find some $JTO in your wallet? 👀

— Symmetry (@symmetry_fi) January 12, 2024

Better check ;)

TL;DR

- Deposit into their top vaults as soon as possible as they’ve hinted about a potential token launch during Feb (?)

- An additional boost could be related to how many vaults a user has deployed his funds in as well as for how long so I’d recommend depositing into a few top volume vaults

Texture

Coming onto the NFT side of things, first up is Texture. Texture is an NFT lending/borrowing aggregator on Solana. Not only that but for each time you repay your loans, you’ll receive PXLS which then can be swapped at a fixed rate of 10000 PXLS = 1 SOL. This allows you to lower your interest paid making it more profitable for you as a borrower.

They also have a “borrow against tokens” functionality that they’ll be releasing soon and post that, there could be a points system for a potential airdrop in my opinion. Currently, things are as simple as simply lending or borrowing SOL for NFTs via texture and generate volume.

TL;DR

- Borrow or Lend NFTs for SOL to generate volume. Repaying your loans also provide you PXLS which can be swapped for SOL and maybe some future usecase. I’d recommend holding those until need be

- Keep an eye out on their twitter for any potential points system or when they launch their Borrow against Tokens product.

Rain Finance

Another NFT lending/borrowing platform on Solana is Rain Finance. Having launched their points system very recently, you can farm these points or droplets in the hopes of a potential airdrop.

Are you ready for our New Points System?

— Rain.fi 💧 (@RainFi_) January 11, 2024

Droplets, droplets, and more droplets!💦

With this innovative points system, Rainfi is taking a significant step to boost protocol growth and reward our dedicated users! pic.twitter.com/qmqF8pUcdR

Farming droplets here is similar to how you would do it on Texture. Simply lend and borrow SOL for NFTs to earn droplets every day. The number of droplets earned is based on your activity.

TL;DR

- Rain Fi has introduced points system. Farm via lending or borrowing SOL for NFTs and climb the leaderboards

Banx

Final lending and borrowing NFT platform on our list is Banx. Releasing their points and BANX alpha on December 1st, they’ve explicitly mentioned their BANX token plan. Thus this should be a high priority protocol if you want to farm airdrops as currently the competition is very low and could yield in a decently sized airdrop.

The actions for earning points are simple; Simply lend and borrow SOL for NFTs. However, here duration of the loans as well as Loyalty matters. Loyalty will most likely be dictated by how often you utilize Banx for lending/borrowing against NFTs. Finally, you can also stake your BANX NFT to earn higher boost on your points.

TL;DR

- Have explicitly mentioned about BANX airdrop in Q1 2024 after Season 2

- Lend and Borrow SOL against NFTs to earn points

- Also buy and stake your BANX NFT to earn higher boost on your points

Tensor

Last amongst the NFT dApps is Tensor - the biggest NFT marketplace on Solana. Having launched its points system way back in 2023, the best way to have a chance at earning a decent airdrop is to buy their Tensorian NFT and stake that to earn some points and probably pray that they take a snapshot of NFT holders and provide them with an additional token airdrop. Personally, for me it’s a very low priority airdrop due to how diluted it would be.

However, if you still need to farm points on their leader boards, generate volume by buying/selling NFTs on their platform and staking your Tensorian to earn additional points.

TL;DR

- Low priority for me due to over-dilution

- If need to farm points, generate volume by buying or selling NFTs on Tensor

- Also stake Tensorians for an additional boost to earn points and maybe have an allocation of their token airdrop (Could give a small portion to their NFT holders)

Bridges

In this segment of the blog, we’ll be taking a look at 3 different bridging protocols that users can use to farm any potential airdrops. Those 3 are: Wormhole, Mayan Finance and deBridge Finance.

The functionality of all these bridges is pretty much the same - they help you to move your assets from one chain to another without utilizing any CEXs.

We’ll be covering these protocols from highly likely to least likely to airdrop in that order.

Wormhole

Having raised $225 Million in funding, Wormhole airdrop in my opinion shall be huge. Having built a whole ecosystem brick by brick, to qualify for it’s airdrop, utilize all the various products that they have to offer. The most basic way anyone could qualify for their airdrop is to either utilize their portal which is Wormhole’s bridge and transfer assets from ETH to Solana and/or vice versa or the second way is to utilize those applications that have Wormhole integrated in them. You can find those dApps in the Wormhole Ecosystem page.

For an in-depth guide to Wormhole farming, check out the below thread by 0xDarya

Wormhole Airdrop Confirmed🚨

— 0xDarya💎 (@0xDarya_) January 4, 2024

With a $225 million raise and a $2.5 billion valuation, the $HOLE airdrop will be Massive!$HOLE will be larger than $ZRO and others👇🧵 pic.twitter.com/VpvdVTQ4Uo

TL;DR

- Basic methods include utilizing their Portal bridge and generate volume and utilizing those dApps that have integrated wormhole.

- For an in-depth thread on how to farm as much as you can for Wormhole, check out the thread by 0xDarya

Mayan Finance

Having acquired multiple rounds of funding and Series A funding, Mayan Finance is next up on our list. Since it’s a bridge, the rules to farming its potential airdrop is simple; just utilize their bridge and generate volume.

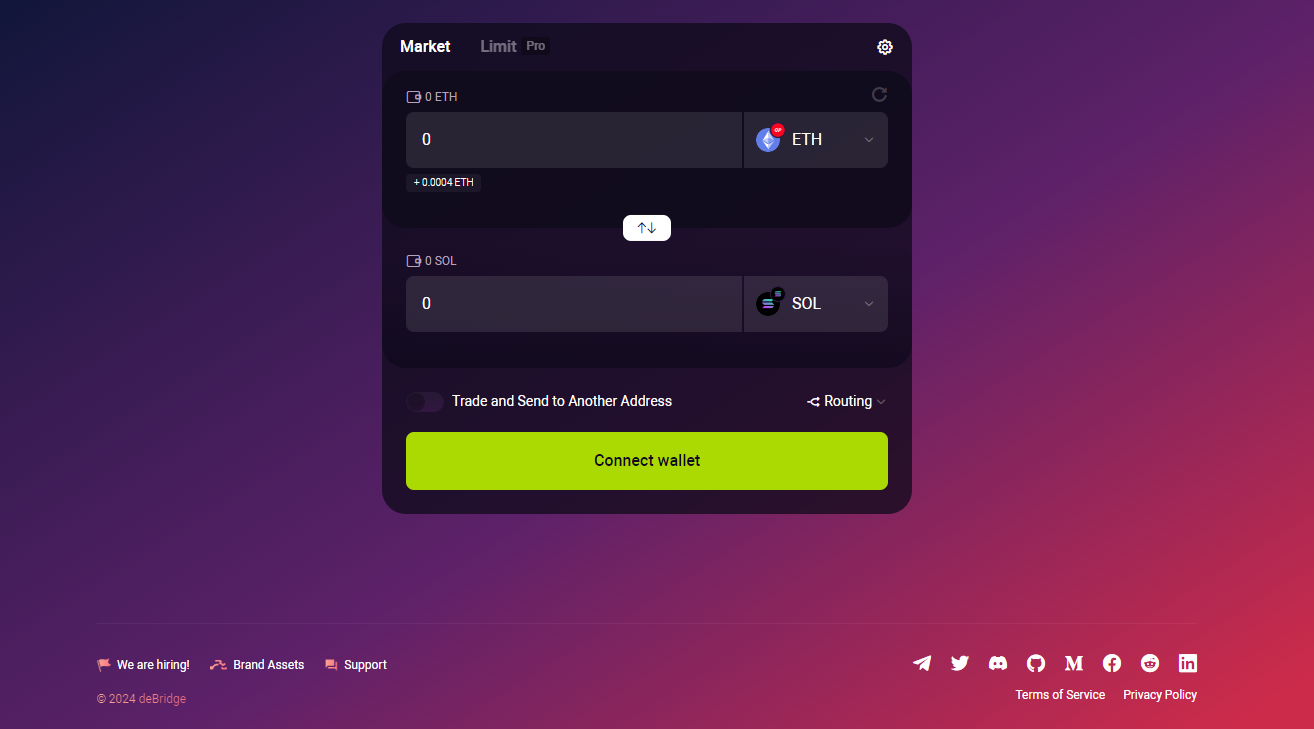

deBridge Finance

Last up in the bridging category is deBridge Finance. DeBridge has also acquired multiple rounds of funding and can be expected to follow the above two bridges if they do release a token. Same as Mayan finance, generate volume via their bridge to farm for their potential airdrop.

TL;DR

- For bridging protocols, generate volume by swapping your assets cross-chain. Utilize L2s and Solana and save on fees as much as you can. Utilizing Ethereum for cross-chain transfers would eat your portfolio up, so DON'T!

Ending Thoughts

So we looked at over 15 different protocols across Solana that any potential user should farm given the low gas fees along with very little total users farming airdrops on Solana. For those with a smaller portfolio, consider diversifying wisely.

For instance, with a $100 starting budget, allocate $20-25 to 4-5 protocols. Include 1-2 established protocols with confirmed airdrops like Jupiter, Zeta, Wormhole, and one with a large farming community but no token announcements yet, such as Drift, MarginFi, Parcl. Additionally, allocate some funds to lesser-known protocols like SymmetryFi, Rain Finance, Texture, Banx to increase your chances of decent allocations.

With this, we’ve allocated our whole portfolio for farming potential airdrops and also come to the end of this blog. I hope this blog enlightened you and hopefully brings you some decent allocations across various protocols.

Happy Farming and don’t mid-curve things,

Midwit